This blog helps renters understand what renter's insurance covers, including personal belongings, liability, and living expenses. It also answers common questions about pets, roommates, and mold, while explaining why renter's insurance is a smart, low-cost investment and how to get started with a policy.

What is Renter's Insurance?

Renter’s insurance is a type of policy that helps protect you and your belongings while you’re renting an apartment, townhome, or house. Many first-time renters or long-time renters overlook this simple but valuable tool.

Unlike homeowners insurance (which covers the structure itself), renter’s insurance focuses on your personal belongings and can even help with certain liability issues.

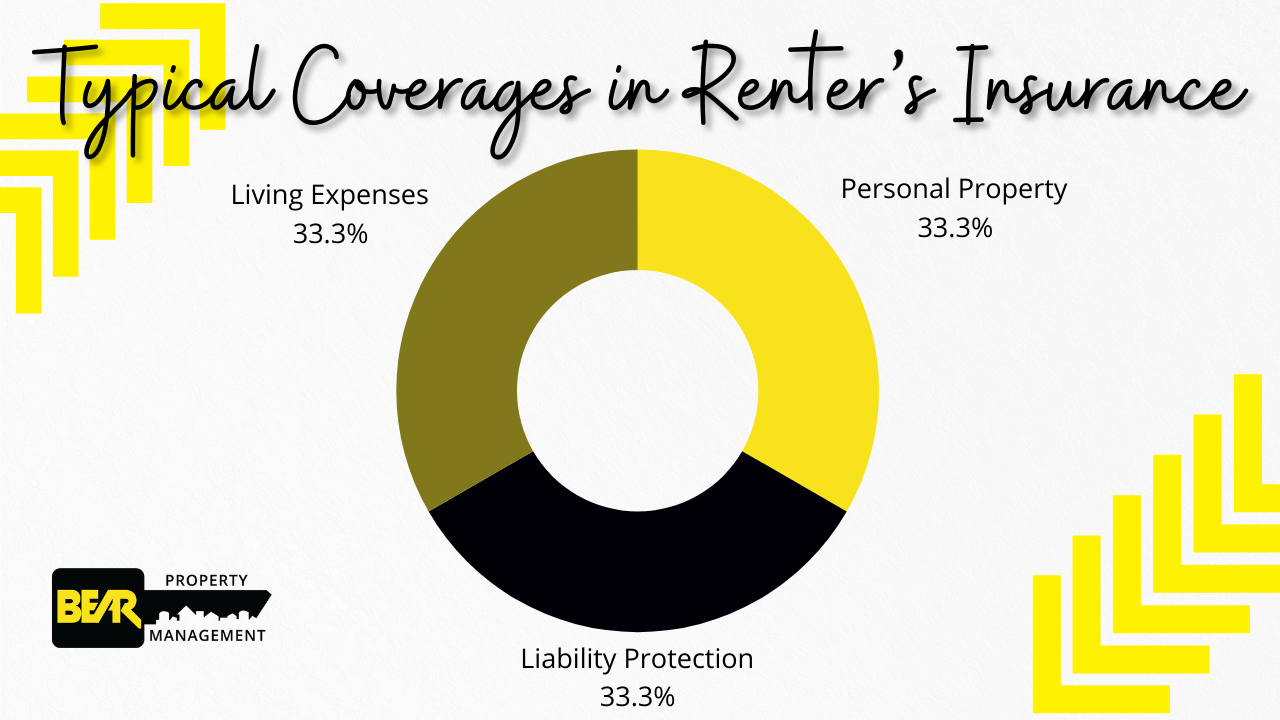

What Does Renter's Insurance Cover?

Find Your Next Rental In Wisconsin

Does Renter’s Insurance Cover Pets, Roommates, or Mold?

- Pets: When you live at a

pet-friendly property, insurance that covers your pets is essential. Renter’s insurance

may cover pet-related incidents, particularly if your pet accidentally injures someone. However, coverage can vary by provider, so check your policy for specific pet liability.

- Roommates: If you’re lucky enough to

find a good roommate, note that a renter’s insurance typically covers only the person listed on the policy. So, your roommate(s) will need their own individual renter’s insurance.

- Mold: Mold damage is typically

not covered unless it’s a result of a covered event, like a burst pipe. It's important to maintain good ventilation at all times, and differently during each season, to avoid this issue altogether.

Is Renter’s Insurance Worth It?

The answer is almost always yes. For a relatively low cost, renter’s insurance provides peace of mind and protection.

According to

NerdWallet, renter’s insurance in 2024 costs around

$115 per year in Wisconsin (about

$9.58 per month), while in Illinois, it averages

$160 per year ($13.33 per month). These rates make renter's insurance a small investment with significant protection. Source:

NerdWallet

In the event of an emergency, having this coverage could save you thousands of dollars in repairs, legal fees, or replacements.

Do I Need Renter’s Insurance?

If you are renting and have valuable personal property (electronics, furniture, clothing), renter’s insurance is a smart investment. Property management or landlords often require it, but even when it isn’t, the low cost is worth the peace of mind.

Steps to Start:

Common Questions About Renter’s Insurance

How Much is Renter’s Insurance?

On average, renter’s insurance costs between $10 and $20 per month. The exact amount depends on factors like location, the value of your belongings, and the amount of coverage you choose.

Does Renter’s Insurance Cover Mold?

Mold is typically only covered if it results from a covered event (like a plumbing issue). General wear and tear or negligence won’t be covered.

Should I Get Renter’s Insurance?

If you rent, have belongings you’d like to protect, or want liability coverage, renter’s insurance is a smart choice. It’s an inexpensive way to safeguard yourself financially.

Renter’s insurance is an affordable way to protect yourself and your belongings from unexpected events like theft, fire, or accidents. With coverage for personal property, liability, and even temporary living expenses, it offers peace of mind at a low cost. Whether you’re a first-time renter or have been renting for years, the benefits of having this type of insurance far outweigh the small monthly investment. Take the first step by assessing your needs and comparing policies—it’s worth it in the long run!